Manage Money: A Practical Blueprint for Financial Freedom

Earning a good salary is a great start, but it’s only half the story. For years, I believed that a rising paycheck was the ultimate measure of financial success. I was wrong. That path, for many of us, leads to a life of bigger expenses, larger EMIs, and a constant feeling of running on a treadmill. You’re moving faster, but you’re not actually getting anywhere.

The “Manage Money” dimension of Irandam Innings is about getting off that treadmill.

This isn’t about complex spreadsheets, risky stock tips, or becoming a financial wizard overnight. It’s about a fundamental shift in your relationship with money. It’s about transforming money from something you constantly work for into something that works tirelessly for you.

This page is the blueprint for that transformation. It’s a collection of the most important lessons I’ve learned, some through painful experience, on the journey from earning a living to building lasting wealth.

My Most Important Lesson: The Painful Story of My ₹8 Lakh Mistake

Before I learned to invest, I tried to get rich.

I was drawn to the world of stock trading. The promise was intoxicating: quick profits, the thrill of timing the market, and the idea of making a month’s salary in a single day. If you search the internet, you’ll find countless “gurus” sharing sure-shot strategies and holy grail methods. Crucially, they don’t share their losses.

Their apparent success made me buy their courses, tips, and services. I jumped in. At first, a few small wins fueled my confidence. I felt like I had found a secret. I started taking bigger risks, convinced I could outsmart the system. The result? I lost ₹8,00,000.

It was a devastating blow. That failure forced me to dig deeper, and I discovered the truth. Many of these gurus were actually making most of their money by selling courses and services that fueled their income to trade. They were selling a dream. That’s when I realized that creating and selling digital products is a great way to make money, but it has to be legitimate. It must be a proper framework, a true dimension of your life, not just an illusion to attract others.

That painful experience taught me the single most important lesson in finance.

⚠️ Biggest Lesson: Trading is not Investing. I had been gambling, not building wealth. I was betting on price movements, not investing in businesses. If you’re checking prices daily, you’re gambling.

This loss forced me to abandon the lottery-ticket mindset and seek a real, sustainable path to financial freedom. This entire pillar is built on the principles I learned after that loss.

The Core Principle: Make Your Money Your Employee

Think about your job. You trade your time and skills for a salary. But your time is finite. You can only work so many hours in a day.

Now, imagine you had an army of employees who worked for you 24/7, never slept, never took a vacation, and their only job was to make more money. That is what your money can do for you when you manage it properly.

💡 Wealth Rule #1: Every Rupee Must Be an Employee The goal is to build a workforce of rupees until their collective income pays for your lifestyle. This is the essence of financial freedom.

It starts with a simple mindset shift: stop seeing money as just a tool for spending and start seeing it as a tool for earning.

The Engine of Wealth: The Unstoppable Power of Compounding

The single most powerful force on this journey is compounding. Albert Einstein supposedly called it the “eighth wonder of the world,” and for good reason.

Compounding is simply earning returns on your returns.

Imagine you have a small snowball at the top of a very long hill. As you roll it, it picks up more snow, getting bigger. As it gets bigger, it picks up even more snow with each rotation. In the beginning, the growth is barely noticeable. But over time, it becomes an unstoppable avalanche of wealth.

Here’s a simple example: If you invest ₹10,000 every month for 30 years and get an average return of 12% per year:

- You will invest a total of ₹36 Lakhs.

- Thanks to the magic of compounding, your investment could grow to over ₹3.5 Crores.

The most crucial ingredient for compounding is not a large sum of money; it’s time. The earlier you start, the longer your money-employees have to work for you, and the more powerful the compounding effect becomes.

My Investment Framework: Building Wealth Without the Stress

After my trading disaster, I committed to a simple, time-tested, and stress-free approach to investing. It’s built on two core pillars.

1. The Stock Market: Become an Owner, Not a Punter

The stock market is not a casino; it’s a platform that allows you to become a part-owner of some of the best businesses in the country. When you buy a share of a company, you are buying a tiny piece of that business. If the business does well over the long term by selling more products, increasing profits, and innovating, your share in that business becomes more valuable.

My approach is based on fundamental analysis: understanding the business behind the stock. I don’t care about daily price fluctuations. I care about the company’s long-term health, its leadership, and its position in the market. This is a calm, patient approach that treats investing like a business partnership.

2. Mutual Funds: The Smartest Starting Point for Most Investors

For most people, trying to pick individual stocks is time-consuming and difficult. This is where mutual funds are the perfect solution. A mutual fund is a professionally managed collection of stocks or other assets. When you invest in a mutual fund, you are instantly diversifying your money across dozens or even hundreds of companies.

Why are Mutual Funds so powerful?

- Instant Diversification: You aren’t putting all your eggs in one basket.

- Professional Management: Experts are making the day-to-day decisions for you.

- Accessibility: You can start investing with a small amount of money through a Systematic Investment Plan (SIP). A SIP allows you to invest a fixed amount every month, which builds discipline and averages out your purchase cost over time.

The Foundation & The Accelerator

All the investment knowledge in the world is useless if you don’t have the capital. This comes from a two-pronged attack:

- The Foundation: You Can’t Invest What You Don’t Save. This starts with monitoring your expenses. It isn’t about being cheap; it’s about being intentional. Know where your money is going so you can direct it towards your future.

- The Accelerator: Supercharge Savings by Making More Money. Cutting expenses is one side of the coin. The other is increasing your income. By building new income streams, as explored in the Make Money dimension, you can achieve financial freedom much faster.

The Final Destination: A Life of Choice

When all these pieces come together, they lead to the ultimate goal: Financial Independence.

Financial Independence, or Early Retirement, isn’t necessarily about quitting work and sitting on a beach. It’s about reaching a point where you no longer have to work for money. It’s about having the freedom to choose: to work on projects you love, to spend time with family, and to live a life driven by purpose, not by financial obligation. This is the definition of a stress-free life.

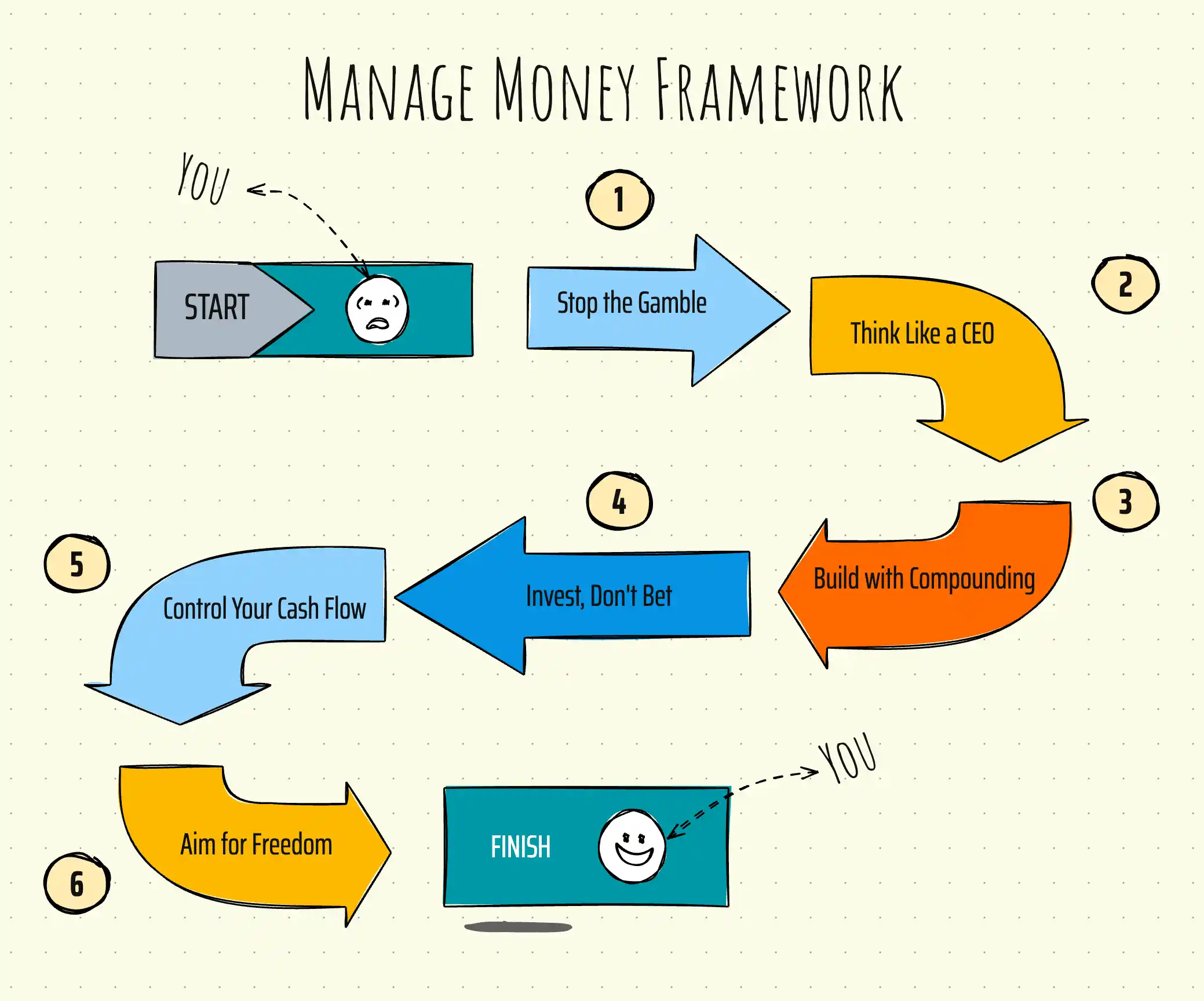

The Framework at a Glance

📌 The Manage Money Blueprint: A Quick Summary

- ❌ Stop the Gamble: Chasing trading shortcuts and daily price-watching is a losing game.

- ✅ Think Like a CEO: Treat every rupee as an employee whose job is to make more money.

- 🧱 Build with Compounding: Understand that time is your most powerful wealth-building tool.

- 📊 Invest, Don’t Bet: Use a long-term strategy with a mix of individual stocks and mutual funds.

- 💸 Control Your Cash Flow: First, monitor expenses to create capital. Then, supercharge your capital by earning more.

- 🚀 Aim for Freedom: The goal isn’t just to be rich; it’s to have the freedom to choose your life’s work.

✅ Next Steps: Dive Deeper

This page is your starting point. To master your finances, explore these essential chapters in the Manage Money dimension:

- (Coming Soon)

Your second innings begins now. It starts not with a massive investment, but with a simple decision to manage your money with intention. This framework is your guide.